Review of what is investing?

So, what is invested? Investing is where you put aside a certain amount of money today to bring you more money at several points in the future. Obviously there is more than that, but in short, it can be created because it takes traffic jams today or by investing it for further jam tomorrow.

Or to see it in another way, you can spend $1,000 today, or invest it and have the same $1,000 worth $2,000 in 5 to 10 years, subject to market returns, of course.

Investing can be defined as making money or capital for assets or activities with the hope or hope of getting additional income or profits at several points in the future. This is really a quick answer to “what is investing”.

It must also be noted ahead, that investment also comes with the risk of loss. Remember the technical phrases that are often quoted, stock can go down and go up and you may not get all your money back! That is the key collection of this beginner investment guide.

Investing through the stock market is usually the most common way for beginners to get their first investment experience.

What is Investment – Are you really made to invest?

It is very important to consider at the beginning of your investment journey if you are really made to invest. We mean, whether you can overcome stress and mental and psychological pressures that come by investing in assets that can rise in value and fall in value, as often happens with stock market investment.

If you are the type of person who will not be able to sleep at night thinking about a little loss with their investment or wake up in the middle of the night with cold sweat because the market has dropped a few percent, then investing may be possible not for you. If you have a very careful view of this money, then you have to put in cash into a savings account and not explore in the world of investing now you know the risk of what is investing.

However, if you are the type of person who understands the potential for the ups and downs of the stock market, and you feel you will not be too concerned with the destruction of the market occasionally and the impairment of your equity everywhere between 10% – 20% or or 20% or even 50% on Opportunities, then invest may be a good long -term approach to grow your wealth.

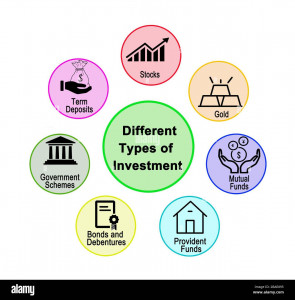

What is Investment – What assets can you invest?

There are many types of asset classes that you can invest, but we will only concentrate on 4 main classes for this investment guide.

What invests in stocks and stocks

Or known as equity is the ownership of some of the companies and businesses registered in every main stock market in the world. When people buy shares and shares, they buy fractional ownership from these business -business and therefore are entitled to proportional fractional ownership benefits, both by increasing capital when the stock price rises, and also the distribution of profits in the same way the distribution of dividends, which can be paid twice a year or on the occasion four times a year.

It should also be noted that being a business owner also means you share in downside, and so if the stock price is reduced due to poor performance, then your investment in business will fall which means capital loss for your portfolio.

What invests in bonds

Also known as corporate bonds, government bonds, or high yield bonds, is another form of investment, but they behave in different ways for stocks and stock investments mentioned above. Bonds are only a one that I owe to you issued by the government or company entity.

When you buy a corporate bond, you are entitled to your investment return known as a coupon or interest rate in ordinary English, and if the interest rate is for example 5%, then you will get a 5% investment return once or twice per year, depending on on how bonds are arranged.

Although corporate bonds are usually classified as safer than stocks and shares and equity, you must also realize that you can lose your capital because of bond investment, either by companies invested for bankruptcy, or they may experience difficulties and cannot pay back bonds or payment Full coupon, therefore means you will lose your dividend payment, or some of your capital is returned or sometimes both.

You also have to realize that the bond trading above or below the PAR value, PAR is usually the price of 100, and when the bonds are in demand, they trade at prices above 100, and vice versa when the bonds are under pressure they are traded at discounts for paren values namely Under 100. The importance of this is that if you buy a bond on PAR says 110 Pence and hold it to the due date of the bonds at several points in the future, the bonds will only pay back 100 at the due maturity, and so there is a reduction 10% guaranteed in your capital if you hold this bond until due. So you have to be careful by buying bonds above their nominal value.

What is invested in property

Also other general investments, and even though you will most likely not buy a full -sized house, you can buy shares in property funds that aim to pay income or results based on ownership of funds, such as a large land owner rental unit for one of the office blocks of one office, shopping center, or retail park. This type of property investment can be a good diversification of standard stocks and stock investments, and small ownership in property is usually recommended in the portfolio of most people.

What invests in commodities

Like gold, silver, platinum, oil, natural gas, energy, or even slim pigs, all of them can be traded and used as an investment. Commodity investment is considered a much higher risk than standard bond property and stock and stock investment, so that only a small portion of novice investment must be allocated for commodities, and these commodities usually have to be mainstreams such as valuable metals and oils.

What is investment – how can you invest?

Now you can answer what questions are invested, we also need to consider how you can invest?

The main way to invest in the 21st century is through online brokers for trade, or more common online platforms that act as information centers and intermediary facilities. The main online platforms in the US are people like Hargreaves Lansdown, Fidelity, CJ Bell, Vanguard, and Interactive Investors. They all have different prices and a slightly different functionality, but their goal is the same and that is to provide one stop shop for retail investors like you and me to be able to get information, review the main facts documents about stocks and stock funds, and later funds To be able to transact purchases, or sell orders on their platforms and of course they want us to remain long -term holders because they get management fees on their platforms every month we live with them.

What is investment – commission and cost

The good news for modern investors is that investment costs are much cheaper than a few years ago. Which said, of course there are still costs involved in investment, and the main thing is the commission and sustainable costs for the administration of the platform, the cost of fund management and others for trade and transaction costs.

If you buy and sell shares and shares, you will be asked to pay a fixed fee that might be $ 10 to $ 15 per trade, plus a 0.5%stamp duty fee. If you buy funds or guardianship, you might be able to buy it for free on several platforms, but then there will be annual management charged by a possible fund manager anywhere between 0.2 and 1.2%, and you also have to pay the platform fee , which can be anything from about 0.2 to 0.45% above. As mentioned above, it should also be noted that many funds and guardians also have other transaction costs that may be included in 0.1 to 0.2% per further fund.

It is very important to make sure you do not pay more than the commission and cost because in the long run this can significantly erode the final value of your investment funds.

What is investment – time frame for investing

The old proverb for the investment period is at least around five years, but in a newer time it is recommended that the horizon of time that is closer 10 years or more is better, to get out of the inevitable tides of the stock market, and also benefit from miracles compound interest during that time period.

If you realistically need your money back in just a few years, then investing may not be the right vehicle for you, unless you can tolerate the risk again than you actually invest.

What is Investment – Funds versus Stock

As an investor, you need to decide whether you invest your capital into individual shares and shares or funds or guardians. Both funds and guardianship are portfolios that are managed professionally from various individual ownership, and automatically provide several diversification for your investment.

On the other hand, when you buy individual shares and shares, you automatically take a higher risk, because individual shares and shares can have a bigger movement both up and down and of course can also occur as a whole, and therefore and therefore you will lose all your investments.

What is investment – diversification and risk reduction

Hand of woman watering green dollar tree growing in white pot

As mentioned above, diversification is an important part of the investment trip. What we mean by diversification is not to place all your eggs in one basket as if and spread your investment around many shares and shares, commodities, regions, and different sectors, to provide portfolios of several balances if some market areas take fall, then others can increase their value, therefore provide some risk mitigation as a whole.

What is investment – summary

So, to conclude the summary of “what is investing” us, investing is a good way to build a significant nest egg for the long term and is highly recommended for as many people as possible to think about investment thinking, and also has a means of getting rid of their cash regularly.

One of the advantages of becoming a new investor is that if you only feed a relatively small amount of money to the market, then a significant withdrawal or fall in the market in the early months and years does not cause too much damage, in reality it can be seen as an opportunity Purchases to add when you see the market lower than you should.

The last word about this is really to continue, if possible, choose a platform, choose an investment / trust fund, and then set the order remain to drip your cash feeding money every month.

By investing the money you have today, instead of spending it, you build wealth and freedom for your future.

What is invested v saving

Investing is different from saving in several ways. When you save, you set aside money in savings products, with a bank or build a community, which will not lose your capital, but also will not have the ability to grow very much. At present, the low interest rate they have ever had, and most banks do not pay literally, 0.01%, so you get zero on the money put into the bank.

Save can be done for a short time and is often used for emergency funds, or for something specific, such as holidays, cars or deposits at home, and correct for short -term savings to be stored in a bank account and not invested, because investment can fall quickly And significant, so you don’t want your vacation funds to lose half the value before the holiday season, or you will end up at Butlins US, not Maldives!

Investing on the other hand, is about trying to make your money grow significantly from time to time, using capital appreciation, and the magic of compound interest. When investing, you look for an overall average return or around 7% -15% per year return, although the actual return will be very volatile and even negative in a few years.

It is not a short term project, and should not be considered for periods of time of less than five years. Ideally, your investment time frame should be measured in decades, and be started as soon as possible.

Investing also involves risk, meaning your capital is at risk of reducing or even being lost altogether.

You will learn more about what is investing by reading the pages in this section of the website.